cvs

Latest

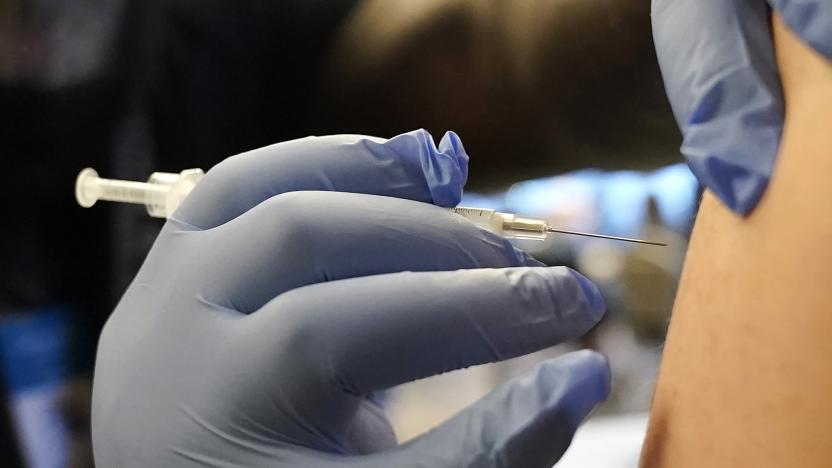

The new COVID-19 vaccines are here for the fall

A new lineup of COVID-19 vaccines are now available in the US. The CDC is urging most Americans to get an updated COVID-19 vaccine.

Malak Saleh09.14.2023

CVS Health will begin manufacturing cheaper 'biosimilar' drugs

CVS Health is launching a new subsidiary unit, Cordavis. This new arm will collaborate with drug manufacturers to produce medications that are near identical to an already approved and existing drug for cheap.

Malak Saleh08.24.2023

CVS won’t fill prescriptions for controlled substances from two telehealth companies

It cited concerns with Cerebral and Done Health.

Kris Holt05.25.2022

CVS Pharmacy now offers audio prescription labels across the US

Following a trial in 2020 involving 1,700 locations across the US, CVS is expanding the availability of its Spoken Rx audio prescription labels to all 10,000 of its pharmacies nationwide

Igor Bonifacic12.01.2021

CVS now accepts QR code payments from PayPal and Venmo

CVS is rolling out promised QR code payments using PayPal and Venmo, giving you a touch-free purchase option at the pharmacy.

Jon Fingas11.16.2020

DoorDash will deliver non-prescription essentials from CVS

DoorDash is now delivering non-prescription items from CVS.

Christine Fisher06.15.2020

Nuro will test autonomous prescription delivery for CVS

Nuro will use its autonomous vehicles to deliver CVS Pharmacy prescriptions to customers in Houston.

Marc DeAngelis05.28.2020

UPS will use drones to deliver prescriptions to retirees in Florida

Residents of The Villages, Florida will soon be able to get their drug prescriptions delivered to them partly by air.

Igor Bonifacic04.27.2020

CVS starts delivering prescriptions to homes via UPS drones

It didn't take long for UPS and CVS to start delivering prescriptions by drone. The two have confirmed that they completed their first paid home deliveries of prescriptions, hauling medicine to two homes (one of which was a retirement community) in Cary, North Carolina on November 1st. The drones flew autonomously and lowered the packages to the ground with a cable and winch, although there was a human operator ready to take control.

Jon Fingas11.05.2019

UPS and CVS plan to deliver prescriptions via drone

UPS isn't going to let Wing's team-ups with FedEx and Walgreens go unanswered. The company has reached an agreement with CVS Pharmacy to create a "variety" of drone delivery uses, including delivering prescriptions and other goods to homes. Neither company provided a timeline for when you might see these drones in action, although UPS recently became the first company with FAA approval to operate a drone airline.

Jon Fingas10.21.2019

Google Photos has a new stories-style 'Memories' feature

The cameras on our phones keep getting better, and we keep taking more and more pictures. That presents a challenge for for Apple and Google: how to surface the best moments out of the thousands of photos we shoot every year? iOS 13 has a new intelligent view that shows users highlights from any day, month or year, and now Google's making some changes to its Photos apps to help people see meaningful pics from the past. Unsurprisingly, the new feature is called Memories, and it uses the popular "stories" format you'll see in Snapchat and Instagram to show you photos from your past.

Nathan Ingraham09.12.2019

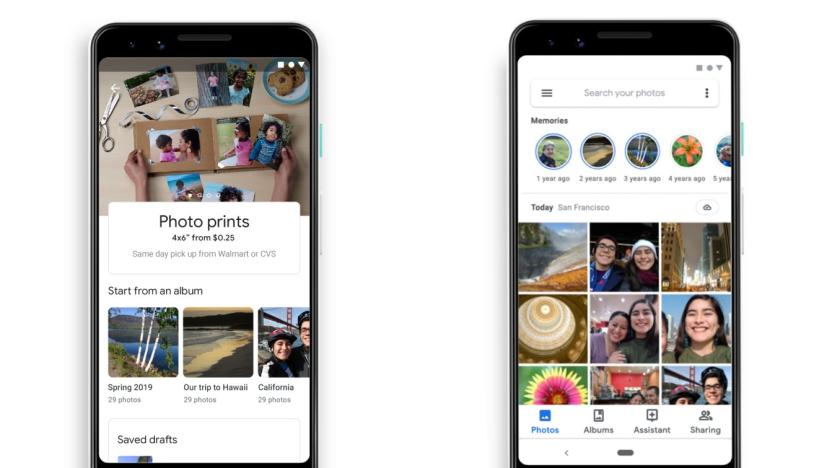

Google Photos will let you order same-day prints from Walmart or CVS

Google Photos has given users the option to create and buy physical photo books since 2017 -- now it looks like the app is expanding to offer prints and canvas prints as well. In an APK teardown of the latest version of the app, 9to5Google found that Google plans to work with CVS or Walmart to deliver same-day pickup for 4x6 inch photo prints, as well as a number of options for canvas prints with three-day print times.

Rachel England09.04.2019

CVS Pharmacy now accepts Apple Pay

Back in July, Tim Cook revealed that Apple Pay would finally be coming to CVS. And now it's finally happened: You can now use the payment method to purchase items at the popular drugstore chain.

Swapna Krishna10.11.2018

Apple Pay comes to 7-Eleven and CVS later in 2018

Apple Pay is making its way to two of its fiercest opponents. As part of Apple's financial results call, Tim Cook revealed that both 7-Eleven and CVS would introduce support for the tap-to-pay service (and, by extension, equivalents like Google Pay) later in 2018. He also confirmed that Germany would offer Apple Pay by the end of the year. There wasn't any mention of how quickly it would roll out to the two retailers or why they'd changed their mind, but the news likely represents an admission of defeat for the two store chains.

Jon Fingas07.31.2018

CVS buys health insurer Aetna to counter Amazon

Amazon is considering diving into the pharmacy business, and that's making incumbents nervous... so nervous, in fact, that it just sparked one of the larger acquisitions in recent memory. CVS Health is acquiring the insurance giant Aetna for the equivalent of $69 billion in a bid to create a highly integrated health care provider. You could get care right from your nearby CVS locations, and you'd have a one-stop shop for health that (theoretically) lowers costs, albeit by giving up choice. If regulators don't object to the deal, it should close in the second half of 2018.

Jon Fingas12.03.2017

CVS launches its own mobile payment system

CVS, which has yet to adopt Apple Pay and other NFC-based payment services, has launched a mobile payment solution of its own. It's aptly called CVS Pay, and it shows a barcode on the phone screen that the pharmacy can then scan to ring up your purchases, so long as you link a credit or a debit card to it. You can also present the barcode to pick up prescriptions that you can refill and manage in-app, as well as to rack up loyalty points. No need to present your physical rewards card at the counter anymore.

Mariella Moon08.12.2016

The After Math: Periscope views and new Samsung phones

While Google was busy reinventing itself as Alphabet, Twitter quietly annihilated its 140 character limit for direct messages, and Samsung released two new, big phones with appropriately big names. Here's a completely numerically biased version of the week's events.

Andrew Tarantola08.16.2015

Apple responds to the Rite Aid, CVS debacle in a very 'Apple' way

Apple is a company of actions, not words. Even when Tim Cook takes the stage to talk about how great his company is, it's always about the here and now, not empty promises about the future. Apple's official response regarding the refusal of Rite Aid and CVS to support Apple Pay -- the company's newly launched NFC payment system -- is deliciously "Apple" in that very same way. Provided to Business Insider, the statement reads: The feedback we are getting from customers and retailers about Apple Pay is overwhelmingly positive and enthusiastic. We are working to get as many merchants as possible to support this convenient, secure and private payment option for consumers. Many retailers have already seen the benefits and are delighting their customers at over 220,000 locations. In case you're having some trouble reading between the lines, let me translate that for you: Dear Rite Aid/CVS, People are already in love with Apple Pay and it doesn't matter if you don't like it. CurrentC is a disaster -- no, seriously, it has a 1-star rating with over 1,200 reviews -- and the only ones you're hurting by refusing to support our payment system is your own customers. Oh, and Walgreens already accepts Apple Pay, so you can either fall in line or make a nice little shanty over there on the wrong side of tech history. Love, Apple

Mike Wehner10.27.2014

A closer look at CurrentC: The reason why CVS and Rite Aid are disabling Apple Pay support

Over the weekend, CVS disabled NFC support on its POS machines at all of its nationwide store locations, effectively blocking out support for NFC-based mobile payment solutions like Apple Pay and Google Wallet in the process. Together, CVS and Rite Aid are the first two stores who have taken pro-active measures to disable support for Apple Pay after customers had already began using the payment platform there successfully. Unfortunately, they may not be the last. As we've indicated previously, the impetus for CVS and Rite Aid's decision to disable Apple Pay (and any other mobile payment platform for that matter) stems from their support of CurrentC. CurrentC is an upcoming mobile payments platform developed by a company called Merchant Customer Exchange (MCX). MCX enjoys the backing of a number of top tier retailers, including Walmart, Best Buy, CVS, 7-Eleven, and dozens more. But just what is CurrentC, exactly? Moreover, does it pose a legitimate competitive threat to Apple Pay? To help answer those questions, Josh Constine of TechCrunch over the weekend took an in-depth look at CurrentC and provides us with a number of previously unknown details surrounding the competing payment platform. With respect to stores like CVS and Rite Aid disabling support for Apple Pay, that stems from contractual obligations MCX members have made not to support competing mobile payment platforms. In January 2013, Fierce Retail reported MCX had been asking retailers in 2012 to pay a big upfront fee from $250,000 to $500,000 to get on board, and sign three-year mobile payment app exclusivity deals with MCX. Retailers who signed up may have had a one-year grace period from the start of their exclusivity contract to bail out of the deal. If Apple Pay gains steam early, some retailers might look to take advantage of this option to ditch MCX. However, if deals were signed in 2012, that grace period is long gone but retailers may be coming up on the end of their exclusivity agreements even though CurrentC hasn't launched yet. Well, so much for open competition and giving consumers the option to choose how they'd like to pay for items. And while Apple Pay was designed to be a completely seamless, intuitive, and unobtrusive process, CurrentC sounds like a usability nightmare. Instead of relying upon NFC and credit cards, CurrentC relies upon QR codes and is linked to a user's checking account. Yep, you read that correctly... QR codes. When it's time for a user to check out, they request to pay with CurrentC. The consumer then unlocks their phone, opens the CurrentC app, opens the code scanner, and scans the QR code shown on the cashier's screen. In some case, the reverse may happen where the consumer's CurrentC app displays a payment code and the cashier scans it. If a QR code can't be generated, a manually entered numeric code may be offered. Rather than sending the customer's financial data over the air, transactions trigger the transmission of a token placeholder. This is then securely converted by the financial institution to process the ACH payment and charge the user. MCX will likely position CurrentC as a mobile payment platform designed to provide customers with greater access to in-store discounts and loyalty rewards programs. While true, make no mistake about the true aim of CurrentC; giving retailers more control of and access to shopper information and buying habits. CurrentC notes it may share info with your device maker, app store, or developer tool makers. Oddly, it will collect health data. Precise location information is used to verify you're at the retailer where you're making a transaction, and if you opt in it can be used for marketing or advertising. And if that weren't enough, CurrentC requires users to enter in their drivers licence number and social security number. The following photo was taken straight from CurrentC's support website. Taking a look at Constine's full article, it's truly hard to fathom any scenario in which CurrentC actually gains traction with consumers. Especially when measured against the consumer-oriented Apple Pay, CurrentC, both in design and in operation, appears to be more appealing for big time retailers than for actual consumers. This brewing battle between competing mobile payment platforms may play out rather slowly. CurrentC isn't slated to go live until early 2015 and it'll likely be a few good months before we can accurately gauge the potential long-term impact Apple Pay will have on the marketplace. Maybe Apple Pay will revolutionize mobile payments. Maybe it won't. But it's hard to imagine CurrentC, despite its support from big name retailers, having any sort of widespread impact on mobile payments. If anything, the recently released details of CurrentC only serve to highlight how much more compelling and user-friendly Apple Pay is. Comically, the CurrentC app on iTunes already has a solid 1-star rating. One reviewer writes: This app would only provide me with less security and less convenience. Marketed as a better solution than carrying around credit cards, it then lists features that are worse than any card I've ever heard. I don't want my checking account information (yes they want to be directly linked to your bank) and for some reason health data out in some retailer's cloud systems. One star is too good for this thing. And policies around stores using this payment system lock out any other mobile friendly ways of paying, like anything that uses NFC, for no other reason than that they can't track data on you as well if you don't use their system. That locks out things like Google wallet and Apple Pay. Here's a novel idea, take my money however I want to hand it you when I want to pay for something. If you don't want my money, well, I guess good luck with that business model. This app and the incorporated system symbolizes the epitome of not realizing anything about consumers' rights or wants to the point of actually being the opposite of what the people want. Hear, hear. For an additional take on CurrentC, make sure to check out a great piece from Rich Mogull over at TidBITS.

Yoni Heisler10.27.2014

RiteAid and CVS disable Apple Pay in preparation for rival payment system CurrentC

According to The New York Times, both Rite Aid and CVS have disabled Apple Pay payments as an available mobile payments options. Rite Aid confirmed the move, while CVS has not responded to inquiries about the change, which was allegedly instituted this week according to consumer online reports. Ashley Flower, a spokeswoman for Rite Aid, said the company "does not currently accept Apple Pay." She added that Rite Aid was "still in the process of evaluating our mobile payment options." It is thought the pair are rebuffing Apple Pay in order to advance support on a rival mobile payment system being developed by Merchant Customer Exchange, or MCX. This consortium of retailers include Walmart, Best Buy, 7-Eleven and others. MCX's payments system, CurrentC, is expected to debut next year and will include the ability for merchants to track customer shopping habits as well as process payments. Apple Pay launched last week with support from a all major credit card companies and a variety of retailers. The mobile payment system is easy to set up and even easier to use.

Kelly Hodgkins10.27.2014